Child Care Subsidy

Useful information to help you understand the CCS and recent changes from 2023

The Government Child Care Subsidy makes early learning more affordable for many Australians.

From July 2023, the Australian Government will be increasing Child Care Subsidy (CCS) rates for families.

This is incredible news for families, with the changes going some way towards making child care more affordable and inclusive for Australian families.

Key Changes

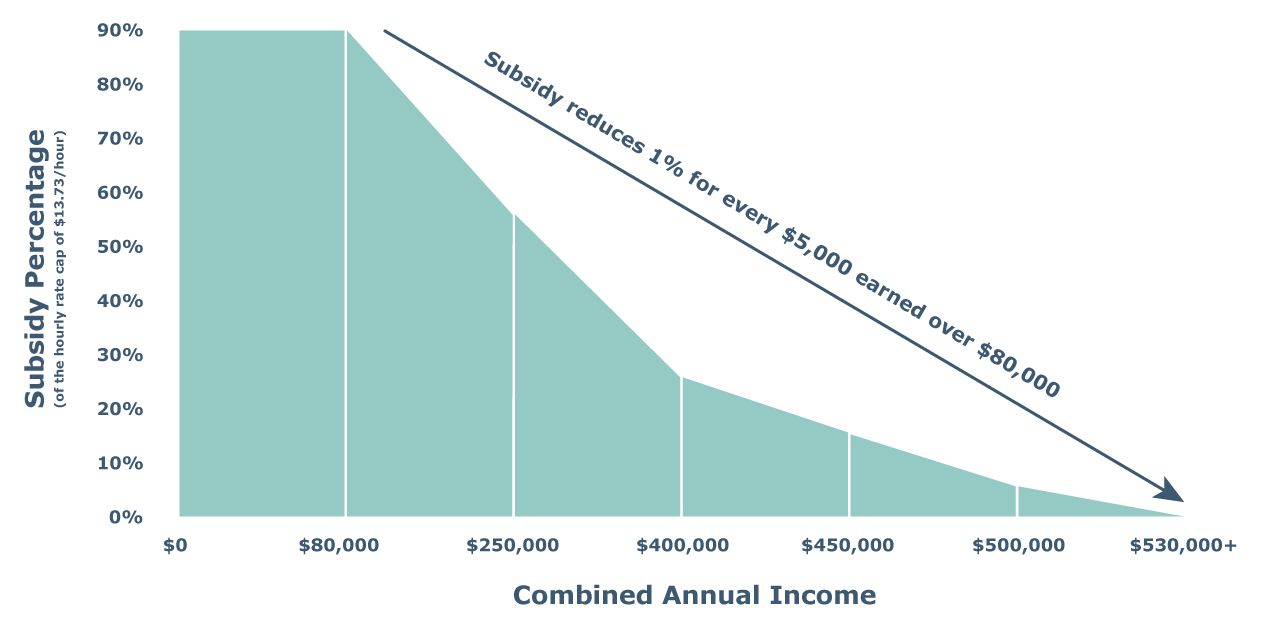

- If your family earns less than $80,000 per year, your Child Care Subsidy rates will increase from 85% to 90%.

- If your family earns under $530,000 per year, you’ll now be eligible to receive Child Care Subsidy rates.

- Your Child Care Subsidy rates will decrease 1% for every additional $5,000 earned over $80,000.

- Families with more than one child aged 5 or under can still get a higher rate for their second and younger children.

- First Nations children will be eligible for at least 36 hours of subsidised care per fortnight.

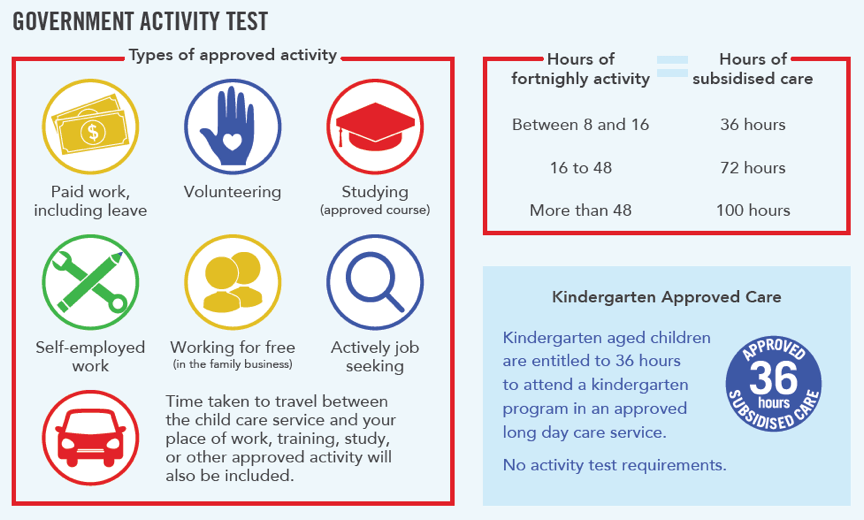

- Families can get more subsidised hours based on their circumstances.

From 10 July 2023, here is how much you can expect to get covered, on average:

*Based on eldest or only child. Families with more than one child may be eligible for a higher subsidy for their second child and younger children.

*The $12.74 hourly cap applied above is a 2022 figure and is subject to change with the Commonwealth Government’s announcement of the 2024 CCS hourly cap changes.

To read more about combined annual income and the annual cap, click here for further information from Services Australia.

How Much Child Care Subsidy (CCS) Will I Be Entitled To?

This will depend on three factors:

- How much ‘work related’ activity (see servicesaustralia.gov.au) you and your partner undertake each fortnight. The entitlement is based on the lesser activity figure for a member of a couple.

- Your total combined family income.

- The amount of early education child care undertaken.

The subsidy you receive and any applicable cap will depend upon your own personal circumstances and is subject to your combined family income, hours of recognised activity and child care details. For more information visit Services Australia’s website at https://www.servicesaustralia.gov.au/child-care-subsidy.

Or, to calculate your CCS, use the CCS calculator at https://startingblocks.gov.au/child-care-subsidy-calculator